The Options Wheel Strategy

Freeman Publications

GENRE: Business & Finance

GENRE: Business & Finance

PAGES: 154

PAGES: 154

COMPLETED: September 28, 2022

COMPLETED: September 28, 2022

RATING:

RATING:

Short Summary

The Wheel strategy has become a reliable way to add supplemental income to your investment portfolio. In The Options Wheel Strategy, the authors at Freeman Publications reveal how to use The Wheel to generate steady premium and trade options safely.

Key Takeaways

Favorite Quote

“We do not recommend a scattered approach where you are repeatedly writing puts on new candidates. Focus on a few good companies that you believe to have good long-term prospects, and then use The Wheel to trade them again and again.”

Book Notes

Introduction

- The Wheel — The Wheel Strategy involves selling cash covered put options and selling covered call options to generate premium. It’s a fairly low-risk strategy that, when used well, can provide your portfolio with an infusion of consistent, nice, reliable income. It can be a great supplement to your portfolio. But it takes time, patience, and discipline.

- Quote (P. 12): “You can make options as complex as possible or you can use them in simple, reliable ways. One of the qualities that makes options trading so enticing is the ability to generate income.”

- Quote (P. 13): “The strategy we’re going to explain in this book, called The Wheel, is a simple one that uses options conservatively. You’re going to learn how to construct a portfolio that will generate anywhere between 15-25% per year in additional income.”

- Quote (P. 16): “Although the technical aspects of this strategy aren’t tough, executing it with patience and discipline is. It takes time for The Wheel to truly produce fruits and you need to be willing to give it time to grow.”

Ch. 1: The World's Most Boring, Yet Reliable, Options Strategy

- Components of The Wheel — The Wheel Strategy uses a few different components to generate income. There are there ways The Wheel can generate income:

- Put Income — You start by selling cash-secured put (CSP) options to generate premium.

- Call Income — If a put option triggers and you are assigned the shares, you then use those shares to sell covered call (CC) options and bring in more premium.

- Spread — When the stock rises above the call option’s strike price, you are then able to execute the option and sell the shares for a few dollars per share more than what you bought them for when you were assigned the put option. Because each option contract involves 100 shares, you make a few dollars on 100 shares. You profit off the spread, as well as all the premium you collected by selling the put and call options along the way.

- Cash Secured Put (CSP) — CSPs are a great way to get paid to own a stock that you want to own anyway. When you sell put options, you collect premium on the contract. If the share price falls beneath your put option’s strike price, it is considered “in the money” and you will be assigned the shares. You will be required to buy the shares at the strike price. If the share price does not fall below the contract’s strike price, you get to keep the premium anyway and you can repeat the process to collect even more premium until you are assigned. The key here is to pick stocks that you’re comfortable owning anyway, even if you are assigned and move to Step 2 in The Wheel.

- Covered Call (CC) — CCs allow you to get paid for selling a stock. Once you’ve been assigned the shares by the put options you were selling, you sell CCs and collect premium on the contract. If the stock rises above the contract’s strike price, you are required to sell the shares at that price. You therefore end up making money on the rise in share price and via the premium you collected. If the share price does not rise above the contract’s strike price, you still were able to collect premium and can repeat the process to collect more premium until the share price elevates above the strike price and you are able to sell the shares.

- Quote (P. 19): “In essence, CSPs pay you to buy shares you like, while CCs can pay you to sell shares that you wish to sell. Trading like this isn’t sexy or exciting. Over the course of a year, this approach can translate into a significant addition to your cash reserves.”

- Takeaway — The Wheel is valuable because it allows you to essentially get paid for buying and selling shares. The key is to pick stocks that are fundamentally sound that you don’t mind owning over the long-term if it comes to it. The ability to collect steady premium is why The Wheel is nice.

- Quote (P. 19): “In essence, CSPs pay you to buy shares you like, while CCs can pay you to sell shares that you wish to sell. Trading like this isn’t sexy or exciting. Over the course of a year, this approach can translate into a significant addition to your cash reserves.”

- Premium — The more volatile a stock, the more premium you will get on the option contract. The risk is that the share price can swing drastically. If you get assigned on your put contract and are required to buy shares, those shares can easily go up or down significantly while you’re holding them. Lower option premiums indicate less volatility with the stock.

- Hit Singles — The Wheel is not meant to deliver huge returns. The best way to use The Wheel is slowly and patiently. Try to earn small, incremental amounts every week using The Wheel. Again, it’s a supplement to your existing portfolio.

- Portfolio Setup — The Wheel should never be a substitution for your portfolio — it’s an addition to it. Delegate at most 10-15% of your portfolio to The Wheel.

Ch. 2: How The Wheel Works — Step by Step

- Steering The Wheel — The Wheel should really be viewed as a way to make some additional income to acquire and maintain a stock you already wanted to own anyway. It should not be used on random stocks. Executing The Wheel Strategy involves following several key steps. These include:

- Step 1 | Pick a Stock — Do your research and identify a stock(s) that you would not mind owning/would love to own if your put option gets assigned and you are required to buy 100 shares (or more depending on the number of contracts). The stock should have good fundamentals and a solid long-term outlook. The big risk with The Wheel is that you get assigned and then the stock tanks. You can avoid this by doing your homework and picking good stocks. It’s critical to pick stocks you want to own anyway.

- Step 2 | Sell Cash-Secured Puts — Once a stock has been picked, write put option contracts on it by selecting a strike price and expiration date. The expiration date can be in a week or a month. The longer out the expiration date is, the more you get paid in premium. You then collect premium and wait to see how the stock responds. There are two scenarios in play here:

- Assignment — If the share price finishes below the strike price, you are required to buy the shares you were OK with owning anyway at the strike price, but you get those shares at a lower cost basis because you collected premium.

- Non-Assignment — If the share price finishes above the strike price, you do not get assigned and get to keep your premium. You can then continue to sell put options to collect premium until you do get assigned the shares.

- Step 3 | Sell Covered Calls — Once you’ve been assigned and buy 100 shares of the underlying stock, sell call options and collect premium on the contract. The longer out the expiration date and the closer the strike price is to the actual share price, the more you will generate in premium. There are two scenarios that can happen here:

- Called Away — When the share price rises above the strike price, you will be “called away” and will be required to sell the 100 shares. When you get called away, you make money via the premium AND the amount the share price increased while you were holding them.

- Hold — If the share price does not rise above the strike price, you keep the premium and the shares and can repeat the covered call process until you get called away. If the stock starts to tank, you need to either sell the shares and move on (if you’re not confident about the company), or repeatedly write calls with a safe strike price to generate income as it comes back up.

- Rolling — You can roll an option contract over to the next week or month by buying it back and selecting a different strike price. You don’t have to wait until the contract’s expiration date to make a move. Buying back contracts can prevent you from being assigned or called away.

- Ex. Put Option — If it’s looking like the share price is going to finish below the strike price on your put option — which would mean you would be required to buy 100 shares of the stock — you can avoid assignment by buying back the contract and therefore closing the position. You can then “roll it over” by selling a new put option with a different strike price.

- Ex. Call Option — If it’s looking like the share price is going to finish above the strike price on your call option — which would require you to sell 100 shares of the stock — you can avoid being called away by buying back the contract and therefore closing the position. You can then “roll it over” by selling a new call option with a different strike price.

- Long-Term Stocks — If you own 100 shares of a stock you are really confident in and believe in, you have to be careful with your strike price selection. Pick strike prices that are fairly improbable because that will reduce the risk of being called away. Your premium will suffer by choosing improbable strike prices, but you’ll be able to make a little bit of income while keeping a stock you believe in.

- The Wheel Income Streams — You ultimately make money in three ways using The Wheel to acquire and manage stocks you like.

- Stream 1 — Premium collected from selling put options

- Stream 2 — Premium collected from selling call options

- Stream 3 — Of the three streams, this is the primary profit generator. You make money off the spread between the price you bought the shares at using the put option and the price you sold the shares at using the call option.

- Quote (P. 38): “When viewed overall, you have two income-producing legs and one long stock leg that should bring you long-term unrealized capital gains. The income legs can add an additional 5-10% returns annually and this is what ensures you’ll earn an average of 15-20% annually on your portfolio.”

Ch. 3: Choosing a Broker

- Selecting Your Broker — Commissions and fees can eat into profits. Most brokers don’t charge a lot, but it’s important to keep an eye on this. For The Wheel, it also helps if your broker has tools that allow you to enter strike prices so you can clearly see your break even points and maximum profit and loss scenarios. Look into charting tools and other software programs available with your broker. Two helpful resources anybody can use to help with The Wheel:

- Tradingview.com

- Stockcharts.com

Ch. 4: Choosing the Right Candidates

- Stock Selection — The No. 1 question to ask when choosing stocks for The Wheel is this: “Will I be comfortable owning this stock if I get assigned?” If the answer is ‘yes,’ then it’s OK to move forward. There are a few other things to keep in mind when selecting stocks:

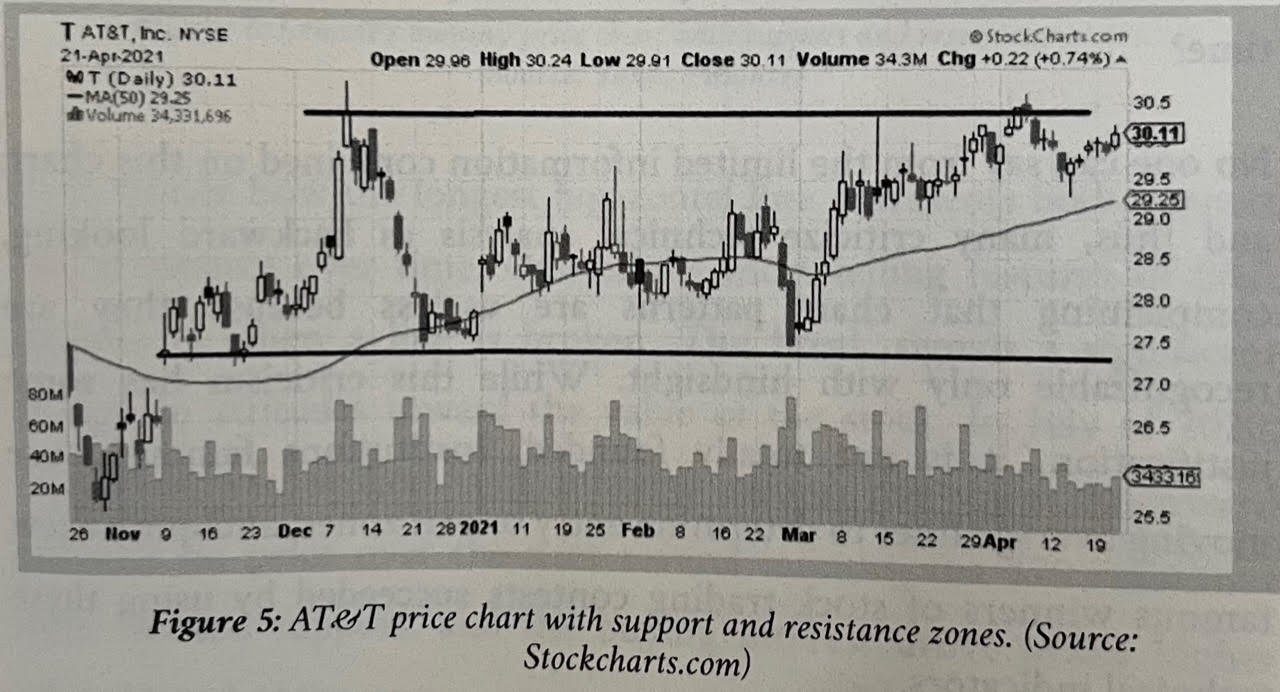

- Trend Characteristics — Ideally, you want to see a stock moving ‘sideways’ or ‘within a range’ when you look at its chart. If you can look at a chart and see clear support at a certain price range, you can sell put options at that support strike price and your overall risk of having the stock tank will be reduced. The reason your risk is reduced is because you’re seeing clear support around that strike price, so even if you get assigned, the stock price is likely to rally back up because of the support, allowing you to sell calls at a higher strike price and eventually make a profit when you’re called away. You want stocks that are moving within a range because it adds a level of predictability that you can lean on. Do not trade stocks that are all over the place.

- Quote (P. 51): “It’s a good idea to examine the stock chart for evidence of support and resistance levels before entering the trade. If you see relatively stable support and resistance levels within which prices are moving, this is evidence of a range or sideways move.”

- The ADX — This is a number that indicates how strong a stock’s trend is. With ADX, trend strengths are ranked on a scale of 0-100. Any number over 30 indicates a strong trend. Any number under 30 indicates an absence of a trend. The ADX doesn’t indicate which way a stock is trending, so you still need to look at the stock’s chart. You can access ADX through charting software programs.

- ETFs — You aren’t just limited to individual stocks with The Wheel. You can run The Wheel on ETFs. Stick to well known, stable ETFs that have proven to be reliable.

- Boring Stocks — You want to run The Wheel on boring stocks that don’t move a lot in share price (i.e. Coke, Microsoft, etc.). These blue chip stocks aren’t as volatile and are therefore a bit more predictable. With stocks that have a lot of growth potential, it makes more sense to buy and hold the shares rather the run The Wheel on them.

- Quote (P. 61): “Because volatility is your enemy when implementing The Wheel, you want to stay as far away as possible from it. Pick boring stocks and boring businesses and you’ll earn steady returns from them through their option premiums.”

- Trend Characteristics — Ideally, you want to see a stock moving ‘sideways’ or ‘within a range’ when you look at its chart. If you can look at a chart and see clear support at a certain price range, you can sell put options at that support strike price and your overall risk of having the stock tank will be reduced. The reason your risk is reduced is because you’re seeing clear support around that strike price, so even if you get assigned, the stock price is likely to rally back up because of the support, allowing you to sell calls at a higher strike price and eventually make a profit when you’re called away. You want stocks that are moving within a range because it adds a level of predictability that you can lean on. Do not trade stocks that are all over the place.

- Stock Screener — Free stock screener websites, like Finviz.com and Barchart.com, can help you identify good stocks for The Wheel. Finviz allows you to insert certain criteria and will find a handful of stocks that meet the requirements. You can then look deeper into those stocks. A few settings to apply in the screener include:

- Dividend Yield — Over 1%

- Average Volume — Over 200k

- Price — Under $100 Per Share

- Earnings Date — Previous Week

Ch. 5: Technical Analysis for The Wheel

- Technical Analysis — An examination of past price movements documented on a chart. Technical analysis is valuable when running The Wheel because it can help you identify a stock’s support and resistance levels. Most charts are ‘candlesticks charts.’

- Body — The body of the candle is a rectangle formed by the stock’s opening and closing prices for the day.

- Wicks — Wicks are the lines extending above the rectangle, indicating the high for the day. This shows you how high the stock rose on that particular day.

- Tail — Tails are the lines extending below the rectangle, indicating the low for the day. This shows you how low the stock fell to on that particular day.

- Support and Resistance — Charts are very helpful when it comes to identifying a stock’s support and resistance levels. Support can be defined as the price where investors step in and begin buying the stock, while resistance is defined as the price where investors begin selling the stock. The chart will show you roughly where the stock typically gains support after dipping a bit. It will also show you where it typically begins to fall after rallying a bit.

- Support and The Wheel — By looking at a stock’s chart to identify a consistent level of support, you can select a strike price near that level of support for your put options when starting The Wheel. When you are eventually assigned the shares, the idea is that support will kick in and allow the stock price to rally back up. You can then sell your call options and eventually sell the stock for a profit along with collecting premium.

- 50-Day Moving Average — Formed by taking the closing prices of a stock over a period of time (50 days) and adding those prices up and then dividing those prices by 50. When a stock is trading above its 50-day moving average, that’s usually a good sign that it will continue to climb higher.

- Trending Up — Generally speaking, you want to run The Wheel on stocks that are trending up and trading above the 50-day moving average. You don’t want to run this on stocks that are trending down.

Ch. 6: How Newer Options Traders Lose Their Shirts — Watch Out for the VIX

- The VIX — The VIX (this is its trading symbol) is the volatility index and it tracks the volatility in the S&P 500. It delivers a number by gathering the volatility of premium on individual S&P 500 index options. In short, it’s the market’s view of volatility for the next 30 days.

- VIX Movement — The VIX rises when volatility in the market is high. If the S&P 500 is rising quickly, the VIX will rise sharply. If the S&P 500 is falling hard, the VIX will rise sharply. The only way the VIX falls is if the market it smooth and calm.

- VIX Up = Premium Up — When the VIX is high, the premium you can collect by selling options is greater in order to compensate traders for the elevated volatility in the market.

- The ‘Fear Index’ — This is a nickname given to the VIX. The best way to think of the VIX is to link it with emotion. It’s tracking the emotion of price movement in the S&P 500. When emotion is high and big price swings are taking place, the VIX is high.

- The VIX and The Wheel — For The Wheel to be effective, we need a steadily moving market that’s either meandering upwards or downwards. A market that’s spiking all over the place isn’t ideal. The VIX allows you to judge how the market is moving. When the VIX is high, it means the market is volatile right now. When it’s fairly low, it means we have the calm market we need to run The Wheel.

- Quote (P. 96): “Stay away from executing The Wheel when the VIX is greater than 30. Any value greater than this indicates a very volatile market, and you never know if that volatility could spread to your stocks.”

Ch. 7: Greeks for The Wheel in 15 Minutes

- Delta — A call or put option’s delta rating hovers between 0-1 and can be thought of as the probability that the stock will land “in the money.” For example, if an option’s delta rating is 0.75, there’s a 75% chance that the stock will land in the money when the contract expires in the near future. Delta rises as the stock’s market price gets closer to the option’s strike price and as the option’s expiration date gets closer (less time on the contract).

- Collecting Premium — If you’re objective is to avoid assignment and simply collect premium, stick to options with a delta of 0.3, which essentially means there’s a 30% chance of being assigned.

- Theta — Theta captures the rate at which an option’s value decreases as time passes. As an option gets closer to its expiration date, its value decreases. This is why you get more premium when writing options that expire further out. A lot can happen over that longer timespan.

- Quote (P. 102): “This is why we’ve repeatedly mentioned that its best to write options that have between 30 and 45 days until expiration. By doing this you’ll capture the maximum premium possible before it starts declining.”

- Quote (P. 104): “To summarize, pay attention to options deltas and maximize theta decay by writing close to the money options that are 30-45 days away from expiry.”

- Takeaway — If you want to run The Wheel a little more passively and collect more in premium, write options that expire in the 30-45-day window rather than weekly.

Ch. 8: Executing the Wheel Strategy — Putting It All Together

- The 1% Rule — In general, you should look for stocks whose premiums are at least 1% of the stock price. If the stock is selling for $30 per share, for example, you want the premium to be at least 30 cents. This ensures you get a solid premium for writing the option.

- Can’t Go Wrong — When used correctly and for the right reasons, it’s hard to go wrong with The Wheel. The strategy should be used to get paid for acquiring shares that you want to have anyway. If your aim is to get assigned, then write your put options as close to the money as possible. You’ll collect a large premium and the probability of your put being assigned will be high. Where you can go wrong is if you begin trying to run The Wheel on random stocks just to collect premium. That is not how it should be used.

- Quote (P. 106): “If long-term investment is your objective, then assignment shouldn’t worry you. In fact if long-term investment is your goal, it’s hard to see how The Wheel can negatively impact you.”

- Quote (P. 113): “We do not recommend a scattered approach where you are repeatedly writing puts on new candidates. Focus on a few good companies that you believe to have good long-term prospects, and then use The Wheel to trade them again and again.”

Ch. 9: Adjustments for Short-Term Investors

- Short-Term Wheel Trading — Although The Wheel is best used to acquire stocks you like, it can be used as a short-term strategy as well via consistent collection of premium. The best way to do this is to write 30-day put options and close them out after 9-10 days. Your goal with this short-term approach is to collect premium and avoid assignment. When you do this, you’re able to collect small premium gains almost every week. A good mark to shoot for is to close the option when you’re able to capture 90% of the maximum profit on the option.

- Quote (P. 119): “So always close out early. This removes the risk of assignment and allows you to capture profit as much as possible. You can also free up your capital to initiate more trades. This means you can earn more money, even if you aren’t capturing maximum profit all the time.”

Ch. 10: Money Management

- Disciplined Approach — The Wheel should never represent more than 10-15% of your portfolio. Be disciplined enough to investigate the stocks you run The Wheel on and don’t get carried away with this strategy. It should be a supplement to your portfolio, not the meat of it.