The Interpretation of Financial Statements

Benjamin Graham

GENRE: Business & Finance

GENRE: Business & Finance

PAGES: 144

PAGES: 144

COMPLETED: January 16, 2022

COMPLETED: January 16, 2022

RATING:

RATING:

Short Summary

In this investing classic, Benjamin Graham takes readers on a line-by-line journey through the common items found in a typical company’s balance sheet and income statement. The legendary investor shows readers how to spot favorable trends and how to interpret key financial ratios.

Key Takeaways

Favorite Quote

"At bottom, the ability to buy securities successfully is the ability to look ahead accurately."

Book Notes

Introduction

- This book is designed to help you read financial statements intelligently.

- Quote (P. VII): “Of course the success of an investment depends ultimately upon future developments, and the future may never be forecast with accuracy. But if you have precise information as to a company’s financial position and its past earnings record, you are better equipped to gauge its future possibilities.”

- You’re looking for growth when you invest in a company!

Ch. 1: Balance Sheets in General

- A balance sheet shows where a company’s financial health stands at a given moment.

- It’s a snapshot of a company’s financial position as of a single day in time.

- Ex. December 31, 2020

- It’s a snapshot of a company’s financial position as of a single day in time.

- A balance sheet shows how much the company has and how much it owes.

- What is has = Assets

- Property, intangible assets, goodwill, cash, accounts receivable, etc.

- What it owes = Liabilities

- Debt, accounts payable, etc.

- What is has = Assets

- Formula: Assets = Liabilities + Shareholder Equity

- The balance sheet will always balance. Shareholders Equity is technically a liability because it is capital owed to shareholders, so we add it to liabilities.

Ch. 2: Debits and Credits

- Business accounting goes by the debit and credit entry system.

- Every debit entry is accompanied by a corresponding credit entry so the books are always balanced.

- This is how the balance sheet always balances.

Ch. 3: Total Assets and Total Liabilities

- Strong companies don’t overinflate goodwill to make their assets look good.

- With all balance sheet and income statement measurements, you have to compare to the industry.

- It makes no sense to compare companies not competing in the same industry.

Ch. 4: Capital and Surplus

- Shareholders pay a ‘par value’ for initial stock in a company.

Ch. 5: Property Account

- Property is included under ‘Fixed Assets’ on the balance sheet.

- Land, buildings, equipment, etc.

- The proportion of Total Assets that property/fixed assets takes up will depend on the company and its industry.

- Ex. In 1931, property made up over 88% of Total Assets for Santa Fe Railway, but it only made up 15% of Total Assets for Lambert Company.

- Most companies place property on the balance sheet valued at cost.

- Companies have historically manipulated the value of property to create the illusion that the Total Assets category is greater than what it really is.

- Gotta watch out for this.

- Companies have historically manipulated the value of property to create the illusion that the Total Assets category is greater than what it really is.

Ch. 6: Depreciation and Depletion

- All fixed assets, except land, are subject to a gradual loss of value through age and use, and can be depreciated.

- Amount of depreciation charged each year is based on the value of the property at cost, it’s expected life, and the scrap value when retired.

- The depreciation amount each year appears as a charge on the income statement.

- Depreciation allows a company to lower earnings on the income statement and thus pay less in taxes for the year.

- On the balance sheet, depreciation is added for all fixed assets. It’s presented as an accumulation of depreciation for all assets. It’s basically total depreciation.

- The depreciation amount each year appears as a charge on the income statement.

Ch. 7: Non-Current Investments

- Many companies invest in stocks and bonds of other companies that can be sold at any time, just as every day investors do.

- These are listed as ‘marketable securities’ in the current assets category of the balance sheet.

Ch. 8: Intangible Assets

- Intangible assets are those that can’t be touched, weighed, or measured.

- Most common are goodwill, trademarks, patents, and leases.

- Goodwill — the amount paid in an acquisition that is above book value of the acquired company’s assets.

- Ex. Coca Cola. If another company were to purchase Coke, it would have to pay much more than just the price of assets of the company because the Coke brand name and reputation is so established. The excess amount over the book value of Coke’s assets would be marked as goodwill.

- When analyzing the balance sheet, you don’t want Goodwill to account for a large percentage of the company’s total assets or shareholders’ equity.

- Intangible Assets are approached differently by each company, and values can be all over the place.

- It’s not a category worth significant review.

Ch. 9: Prepaid Expenses

- Prepaid Expenses are expenses for things that the company has paid for in advance.

- Ex. Rent for a building. The company pays $50,000 in advance for a year of rent.

- Prepaid Expenses appear as an asset because, if the company was liquidated, they would get the money back for those prepaid payments in most cases.

- They are shown as a total or accumulation on the balance sheet, and slowly decrease over the course of the year.

- Ex. Some kind of subscription. Each month, 1/12 of the prepaid expense will be reduced until the end of the year, where that particular prepaid expense will be 0.

- Not worth spending a great deal of time analyzing this category.

Ch. 10: Deferred Charges

- Similar to prepaid expenses.

Ch. 11: Current Assets

- Current Assets are those that are immediately convertible to cash or are able to be converted to cash within 1 year.

- Current Assets are composed of three groups:

- Cash and Cash Equivalents

- Receivables

- Inventory

Ch. 12: Current Liabilities

- Notes and debt that must be paid in the next year.

- 1-year notes/debt

- This also includes other, longer term debt that has now reached the point where it is going to be due in the next year.

Ch. 13: Working Capital

- Quote (P. 31): “In studying the ‘current position’ of an enterprise, we never consider the current assets by themselves, but only in relation to the current liabilities.”

- The current position involves two factors:

- Working Capital — The excess of current assets over current liabilities.

- Current Ratio — The ratio of current assets to current liabilities.

- The current position involves two factors:

- Working Capital = Current Assets – Current Liabilities

- Working Capital shows a company’s ability to:

- Conduct business without strain

- Grow without need for new financing

- Survive emergencies without disaster

- The proper amount of working capital will depend on the company and industry.

- Look at working capital trend over time. How is it performing over time?

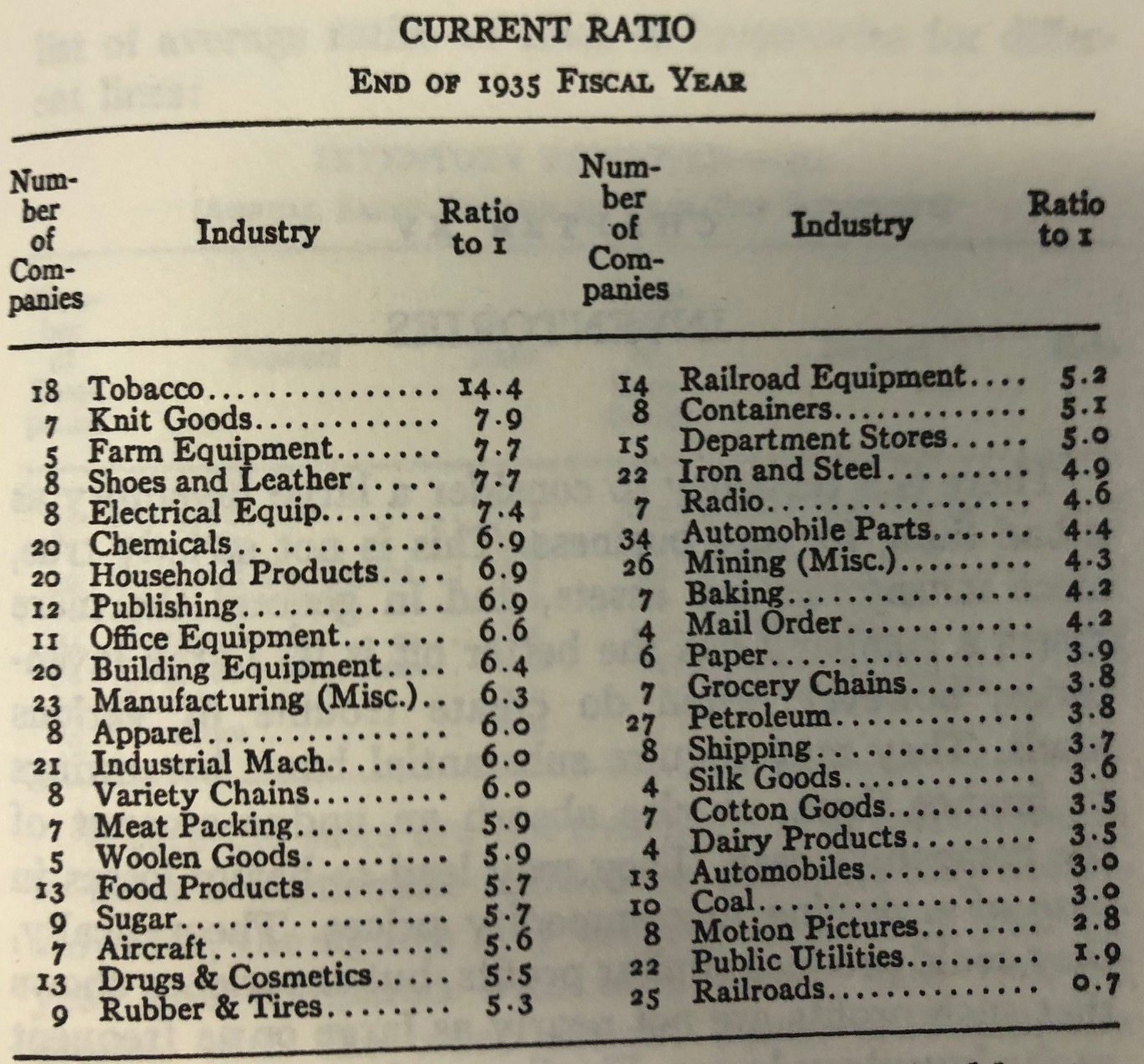

Ch. 14: Current Ratio

- Current Ratio = Total Current Assets / Total Current Liabilities

- Current Assets: $500,000

- Current Liabilities: $100,000

- $500,000 / $100,000 = 5

- Quote (P. 34): “When a company is in a sound position, current assets well exceed current liabilities, indicating the company will have no difficulty in taking care of its current debts as they mature.”

- A typical Current Ratio will vary depending on the industry.

- Quick Ratio = Current Assets — Inventory / Current Liabilities

- This is often a better measure than Current Ratio to judge a company’s liquidity.

Ch. 15: Inventories

- Inventory is an asset, but a company that has a huge inventory is likely having trouble selling, and prices of the goods in inventory might need to be drastically reduced in order to sell.

- Inventory Turnover Ratio = Annual Sales / Inventory

- A good ratio will depend on the business and industry.

Ch. 16: Receivables

- Receivables are what is owed to a company based on sales it has made to customers on credit.

- So incoming cash that is owed to the company.

- If a company has a huge amount of receivables in comparison to sales, there’s a chance it could run into a problem with nonpayments from bad customers that default.

- This is a danger of making too many sales on credit.

Ch. 17: Cash

- Cash is king.

- When a company doesn’t have enough cash, it usually borrows a lot of debt.

- Look for how the company is capitalized.

- If cash per share is much higher than current market price per share, it indicates that the shares are undervalued in the market.

- If you see this, might be worth buying the stock because stockholders are eventually going to benefit from the favorable cash position either through the distribution of a dividend or the company’s productive use of the cash to grow and expand.

Ch. 18: Notes Payable

- Notes Payable is the most important individual item in the Current Liabilities category.

- Usually consists of bank loans, other company loans, or loans from individuals.

- If the amount in Notes Payable is exceeded significantly by cash holdings, this is relatively unimportant.

- If the amount in Notes Payable exceed cash and receivables, it’s a very bad sign.

- The company is capitalizing with debt far too much.

- If the amount in Notes Payable exceed cash and receivables, it’s a very bad sign.

Ch. 19: Reserves

- Reserves are divided into three categories:

- Those representing a liability

- Those representing an offset against some asset

- Those which are part of the surplus

Ch. 20: Book Value or Equity

- Book value is basically the cash value of all assets per share if the company were to liquidate.

- When you hear ‘book value’, think tangible assets.

- There is a rough relationship between book value and average earnings.

- Usually, the higher the book value, the higher the earnings per share.

Ch. 21: Calculating Book Value

- Book value can be found by adding up all tangible assets and dividing by the number of common shares outstanding.

Ch. 22: Book Value of Bonds and Stock

- Add up the value of all bonds and divide by the number of common shares outstanding.

Ch. 23: Other Items in Book Value

- Add up all forms of surplus and divide by common shares outstanding.

Ch. 24: Liquidating Value and Net Current Asset Value

- Liquidating Value differs from book value in that it is supposed to factor in the loss of value during liquidation.

- When a company liquidates, inventory is usually sold for a lot cheaper than what it is set at on the balance sheet.

Ch. 25: Earning Power

- This is where we start looking at the income statement.

- Book value isn’t as important as earning power, which is the company’s ability to produce solid earnings/net profit.

- Earning Power — the earnings that may reasonably be expected over a period of time in the future.

- Current and past earnings are used as a guide because the future is unpredictable.

Ch. 26: Typical Public Utility Income Statement

- Operating expenses include cost of materials, labor, and administrative, etc.

- ‘Other Income’ comes from sources NOT including sales made to customers.

- Ex. Income from investments

Ch. 30: The Maintenance and Depreciation Factor

- The depreciation charge on the income statement should be between 8-12% of gross earnings.

Ch. 32: Trends

- Quote (P. 72): A consistent change in some important factor in the income statement is known as a trend.

- Earnings Per Share (EPS) is a big one.

- Interest coverage is another big one.

- Good or bad trends on the income statement appear due to trends happening with the business.

- Be careful with trends. Make sure it’s sustainable and not just a brief thing.

Ch. 33: Common Stock Prices and Values

- Quote (P. 74): “Broadly speaking, the price of common stock is governed by the prospective earnings. These prospective earnings are, of course, a matter of estimate or foresight; and the action of the stock market on this point is usually controlled by trends. Trends are gauged from the past record and current data, although the expectation of some quite new development will play a determining part.”

- Essentially, stock prices are controlled by investor expectations and opinions after looking at the business and identifying good or bad trends.

- The stock price is usually controlled by analyst and investor estimates.

- Supply and demand is the ultimate driver.

- There are so many factors not related to the company that also affect its stock price.

- This is explained at length in Jim Cramer’s book Get Rich Carefully.

- P/E Ratio is big for judging the price of a stock.

- P/E is a measure of investor expectation.

- P/E above 15 = Investors are paying more because they expect a lot of future growth.

- P/E is a measure of how much an investor is willing to pay for $1 of earnings.

- P/E below 15 = Investors don’t see a lot of future growth, so they are willing to pay less.

- Companies with the same EPS may be trading at completely different P/E ratios because investors have different expectations for each company.

- Think Tesla. This company had a P/E of over 1,000 at one point because everybody was on the Tesla train. Huge future earnings were expected so people were willing to pay a higher market price to get the stock.

- P/E is a measure of investor expectation.

- Quote (P. 75): “At bottom, the ability to buy securities successfully is the ability to look ahead accurately.”

- You want to invest in companies that have a nice growth path and are likely to expand in the future.

Conclusion

- Factors that impact the value of a company’s securities:

- Asset Value (Book Value)

- Earning power of company (Net income)

- Financial position compared to other companies in same industry

- Trend of earnings (Is the company growing?)

- Ability for management to meet constantly changing conditions

- Other factors outside the control of the company

- Events happening in the world, etc.

Part II: Ratios

- Profit Margin

- Divide the total after deducting COGS by total sales.

- Shows the operating efficiency of the company.

- Ex. 9.2%.

- For every $100 in sales, the the company is making $9.20 after COGS.

- Earnings Per Share (EPS)

- Net income / common shares

- Inventory Turnover

- Total sales / inventory

- Ex. $294,778,287 / $61,539,137 = 4.7

- The company ‘turns over’ it’s inventory 4.7 times per year.

- The more times per year a company can turn over its inventory, the less capital is invested in inventory.

- A ‘good’ inventory turnover ratio will depend on the type of business and industry.

- Current Ratio

- Current Assets / Current Liabilities

- Ex. $168,932,293 / $33,472,945 = 5.04

- The company has $5.04 of current assets for every $1 of current liabilities.

- Quick Ratio

- Current Assets (Remove inventory) / Current Liabilities

- Ex. $107,393,156 / $33,472,945 = 3.2

- The company has $3.20 in quick assets for every $1 of current liabilities.

- P/E Ratio

- Market Price Per Share / Earnings Per Share (EPS)

- Ex. $105 / $6.52 = 16.2

- The stock is selling at 16.2 times earnings.

- This ratio is used in determining whether a stock is relatively high or low priced, and as a starting point in comparative analysis.

Definitions of Financial Terms

- Amortization — The process of gradually extinguishing a liability, a deferred charge, or a capital expenditure over a period of time.

- Ex. A mortgage is amortized by periodically paying off part of the face amount.

- Bond — A certificate of debt that:

- Represents a part of a loan to a business corporation or government

- Bears interest; and

- Matures on a stated future date

- Short-term bonds are referred to as ‘notes.’

- Capitalization — The total of the various securities issued by a corporation, including bonds, preferred stock, and common stock.

- Shows HOW a company is funding its operations — ownership (stock), debt (bonds).

- Capital Structure — Related to how the company is capitalized. A company that is capitalized mostly via common stock is considered ‘conservative.’ On the other hand, a company that is capitalized via bonds/debt is considered ‘speculative.’

- Deficit — On the balance sheet, when assets fall short of liabilities. On the income statement, when revenue falls short of expenses.

- Dividend Yield — Found by dividing the dividend payment by the current market price.

- Ex. A company pays $4 dividend annually and the current market price is $80. Calculation: 4 / 80 = 5%. That’s a 5% dividend yield.

- Fiscal Year — The 12-month period selected by a corporation as a basis for computing and reporting profits.

- Some fiscal years end December 31, but many do not.

- Gross Revenue / Gross Sales — Total sales or total revenue before anything is deducted.

- Qualitative Analysis — Analysis that cannot be stated in figures.

- Ex. Management, strategic position, labor conditions, etc.

- Quantitative Analysis — Analysis that can be stated in figures.

- Ex. Balance sheet position, earnings record, dividend rate, etc.