One Up On Wall Street

Peter Lynch

GENRE: Business & Finance

GENRE: Business & Finance

PAGES: 304

PAGES: 304

COMPLETED: February 18, 2022

COMPLETED: February 18, 2022

RATING:

RATING:

Short Summary

Peter Lynch, the legendary money manager who directed the highly successful Fidelity Magellan Fund from 1977-1990, reveals the tactics he uses to navigate the ups and downs of the investing market. Lynch offers advice on analyzing companies, dissecting financial statements, and why normal, everyday investors often have an advantage over the Wall Street big shots.

Key Takeaways

Favorite Quote

"People may bet on the hourly wiggles in the market, but it’s the earnings that waggle the wiggles, long term."

Book Notes

Introduction to the New Edition

- Peter Lynch managed the very successful Vanguard Magellan Fund.

- Managed it from 1977-1990.

- This book was published in 1989.

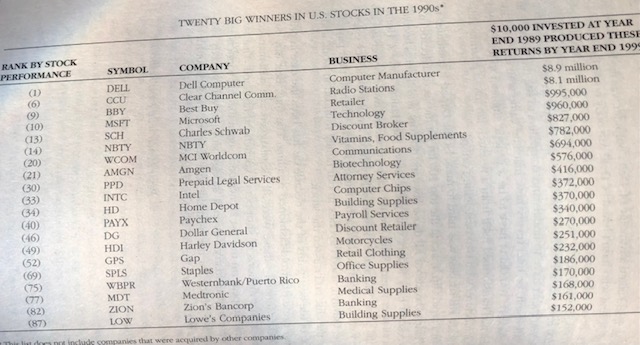

- From 1995-99, the market returned 20% or more every year.

- Before that, the most consecutive years the market had produced a 20% or more return was two years.

- Quote (P. 10): “Today it’s worth reminding ourselves that bull markets don’t last forever and that patience is required in both directions.”

- Bull and bear markets don’t last forever. You have to have patience and discipline to be a good investor.

- Lynch is a fundamental investor. He made all of his picks by looking at the company’s key figures on the income statement and balance sheet.

- He looked for companies that were entering new markets (growth) and producing steadily increasing earnings. When these two things are happening, the stock price is going to go up.

- Quote (P. 13): “To my mind, the stock price is the LEAST useful information you can track and it’s the most widely tracked.”

- Don’t play the stock prices. Look at the company’s fundamentals and P/E ratio. THEN decide if it’s a good buy based on the current stock price.

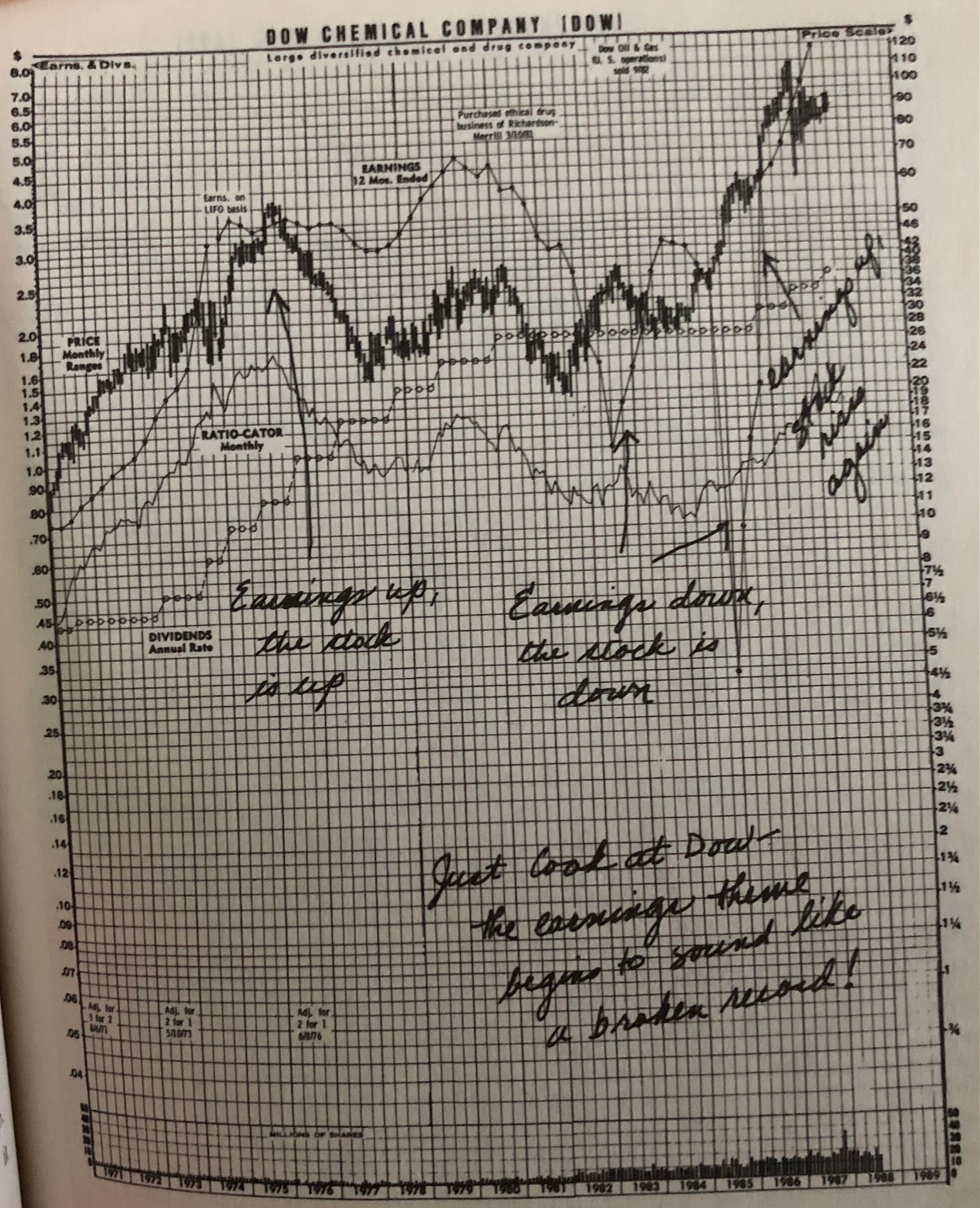

- Quote (P. 13): “If you can follow only one bit of data, follow the earnings, assuming the company in question has earnings. As you’ll see in this text, I subscribe to the crusty notion that sooner or later earnings make or break an investment in equities. What the stock price does today, tomorrow, or next week is only a distraction.”

- We want to see earnings growth. We want to see a company expanding into new markets.

- Ultimately, the stock price is affected by supply and demand in the market and is swayed by a many things that aren’t even related to the company.

- Jim Cramer talks about this at length in Get Rich Carefully.

- Quote (P. 14): “Whenever you invest in any company, you’re looking for it’s market cap to rise. This can’t happen unless buyers are paying higher prices for their shares, making your investment more valuable.”

- Market Capitalization — Number of Common Shares Outstanding x Market Price.

- Small Cap — $0-2 Billion

- Mid Cap — $2-10 Billion

- Large Cap — $10 Billion +

- When you invest in a company, look at its current market cap and decide if it will grow over time based on the current fundamentals of the company and the way its earnings are trending.

- If you believe the market cap will rise, decide a ‘target’ market cap. Ask yourself — What will it take for the company to reach this level?

- Look at the market cap of the company’s industry competitors. Can the company you want to invest in grow to a comparable market cap? If yes, invest in the company.

- The biggest thing you’re looking for is growth. You want companies that are growing, entering new markets, producing new products, and increasing earnings. This will drive the price of the shares up over time and therefore produce a higher market cap.

- Market Capitalization — Number of Common Shares Outstanding x Market Price.

- Quote (P. 16): “An amateur investor can pick tomorrow’s big winners by paying attention to new developments at the workplace, the mall, the auto showrooms, the restaurants, or anywhere a promising new enterprise makes its debut.”

- Pay attention to your surroundings and the world around you. What new products or devices are making waves? What do you enjoy using or buying? The companies that produce these things might be good investments.

- Quote (P. 16): “Never invest in companies before you’ve done the homework on the company’s earnings prospects, financial condition, competitive position, plans for expansion, and so forth.”

- Do your homework!

- Listen to company calls, analyze the income statement, and balance sheet, etc.

- For retail companies and restaurants — it’s important to see how much they’ve already expanded. You want companies that are early in their growth pattern.

- Ex. You wouldn’t want to invest in Toys-R-Us if it’s already established itself in 90% of the country.

- Quote (P. 18): “All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.”

- You don’t have to make money on EVERY stock.

- Still, try to avoid losing money on investments if you can.

- 6 out of 10 winners in a portfolio can produce a good result.

- You don’t have to make money on EVERY stock.

- Share buybacks have become a better way to reward shareholders than dividends.

- When a company buys its shares back from the market (at a good price, presumably), it lowers the supply of the shares in the market, which increases Earnings Per Share (EPS) and raises the market price per share.

- Therefore, the shares rise in price and you can sell them. You’ll be taxed when you sell, but if you’ve held the shares for over a year, you pay the capital gains tax rate (15%) rather than your ordinary tax rate.

- On the other hand, dividends are taxed twice — the company’s profits/earnings are taxed at the corporate level and then you are taxed at your ordinary income tax rate when you receive the dividend.

- When a company buys its shares back from the market (at a good price, presumably), it lowers the supply of the shares in the market, which increases Earnings Per Share (EPS) and raises the market price per share.

- The most realistic look at how the market performed in a single day is the advance/decline numbers.

- These numbers show you how many stocks went up during the day compared to how many stocks went down during the day.

- Looking at the Dow Jones Index or S&P 500 Index can be misleading because they could both be up big for the day while your stocks got hammered on the same day. This is because the performance of these indexes is often carried by a few big companies.

- Ex. 1998 — The S&P 500 returned 28% for the year. But 50 of those companies averaged a 40% return while the other 450 companies barely moved at all.

- Historically, corrections (a 10% drop in the market) occur every two years and bear markets (a drop of 20% or more) occur every six years.

- Quote (P. 23): “If you put $100,000 in stocks on July 1, 1994, and stayed fully invested for 5 years, your $100,000 grew to $341,722. But if you were out of stocks for just 30 days over that stretch — the 30 days where stocks had their biggest gains — your $100,000 turned into a disappointing $153,792.”

- Lesson — don’t try to time or play the market. Do your homework, invest in good companies at reasonable market prices, and hold for the long term.

- Don’t allow your emotions to sway you during a bear market.

- Lesson — don’t try to time or play the market. Do your homework, invest in good companies at reasonable market prices, and hold for the long term.

- Quote (P. 24): “Companies do better or they do worse. If a company does worse than before, its stock will fall. If a company does better, its stock will rise. If you own good companies that continue to increase their earnings, you’ll do well.”

- Keep it simple.

Prologue

- The Crash of 1987 (October 16-20, 1987) — the market dropped 35% in two days, the largest decline since the Great Depression.

- It recovered most of that loss by June of 1988.

- Quote (P. 29): “I’ve always believed investors should ignore the ups and downs of the market.”

- Invest for the long term. Short term fluctuations should not bother you.

- Quote (P. 30): “When you sell in desperation, you always sell cheap.”

- The right time to sell is never when a big decline is happening. That’s the time to buy.

- Buy low, sell high.

- The right time to sell is never when a big decline is happening. That’s the time to buy.

Introduction

- Hitting a ‘ten-bagger’ (an investment that makes 10x your money) just once or twice can boost your portfolio significantly.

- Ex. 1976 — A $10,000 investment in GAP would have resulted in a $250,000 gain.

- Invest in companies you know. Invest in companies that have products you understand.

- Don’t invest in something you don’t understand just because other people are.

- Quote (P. 42): “Finding the promising company is only the first step. The next step is doing the research.”

- Finding little known or out of favor stocks, researching them, and buying them if appropriate can lead to very lucrative investments.

Ch. 1: The Making of a Stockpicker

- Lynch went to Boston College and later Wharton for graduate school.

- He interned at Fidelity while in college. His job was to thoroughly research companies.

- His first investment in college was Flying Tiger Airlines, which he bought at $7 a share. It rose to $32 per share in two years.

- He bought the stock because air freight had a solid looking future and Flying Tiger was an air freight company.

- The Magellan Fund had $20 million in assets and 40 stocks when Lynch took over.

- The fund had $9 billion in assets and over 1,400 stocks by the time Lunch retired in 1990.

Ch. 2: The Wall Street Oxymorons

- 70% of the shares in major companies are owned by institutions.

- If you can invest in a good, promising company that doesn’t yet have many analysts tracking it and institutions investing in it, you could be in for a fun ride.

- Once the institutions start buying it, and the analysts start putting it on their ‘recommended list’, the stock price is going to skyrocket.

- You can easily check institutional ownership of a stock online.

- Once the institutions start buying it, and the analysts start putting it on their ‘recommended list’, the stock price is going to skyrocket.

- If you can invest in a good, promising company that doesn’t yet have many analysts tracking it and institutions investing in it, you could be in for a fun ride.

- The Nikkei Average — The Japanese equivalent of the Dow Jones in the U.S.

- The Nikkei Average was up 17-fold from 1966-88. The Dow Jones only doubled during that span.

- It’s difficult for mutual fund managers to beat the market. The rules are stacked against them.

- The SEC does not allow a mutual fund to own more than 10% of the shares in any company. It also prevents a fund from investing more than 5% of its assets in any stock.

- These rules are designed to encourage the fund to diversify.

- But these rules also almost single handily prevent a large fund from buying small companies at bargain prices. Instead, the fund has to stick to the large market cap stocks that don’t move much. Performance is therefore restrained.

- When a fund gets big in size, it gets harder on the fund manager.

- With the current rules in place, a large fund will have to spread its assets out across a ton of stocks. It can’t just pile most of its money into a couple of stocks. The manager has to put all that money to work somewhere.

- The more companies the fund has to invest in to spread out its assets, the more risk there is that some of the stocks won’t do well.

- The SEC does not allow a mutual fund to own more than 10% of the shares in any company. It also prevents a fund from investing more than 5% of its assets in any stock.

Ch. 3: Is This Gambling, Or What?

- Investing in Debt — Bonds, Money-Market, Certificate of Deposit (CDs)

- These are all forms of debt that pay you interest.

- Bonds are not a bad play when interest rates are high. They are a terrible play when interest rates are low and inflation is high.

- Ex. 1980s — Interest rates were 16-18%. Good!

- Ex. 2022 — Interest rates are 2%. Bad!

- You actually lose money when you invest in bonds in a low interest rate environment when inflation is high.

- 20-year T-Bonds are usually the best because they aren’t callable until the final 5 years to maturity.

- The stock market returned an annual average of 9.8% from 1927-1990.

- 5% — Corporate bonds.

- 4.4% — Government bonds

- 3.4% — T-bills

- The long-term inflation rate is 3% per year.

- Measured by the Consumer Price Index (CPI).

- 1927-1987 — A $20,000 investment in corporate bonds compounded 5% annually would have ended in $373,584.

- The same $20,000 investment in stocks yielding 9.8% annually over the same time period would have ended in $5,459,720.

- Stocks are the better option because you get to participate in the company’s growth. As a bond owner, you’re just a guy lending the company money.

- Quote (P. 74): “By asking some basic questions about companies, you can learn which are likely to grow and prosper, and which are entirely mysterious. You can never be certain what will happen, but each new occurrence — a jump in earnings, the sale of an unprofitable subsidiary, the expansion into new markets — is like turning up another card. As long as the cards suggest favorable odds of success, you stay in the hand.”

- Research the companies you want to invest in. Study them and decide if the future growth prospects are favorable.

- Decide if the current market price values the company appropriately. If so, pull the trigger.

- Quote (P. 75): “If seven out of ten of my stocks perform as expected, then I’m delighted. If six out of ten of my stocks perform as expected, then I’m thankful. Six out of ten is all it takes to produce an enviable record on Wall Street.”

- Quote (P. 76): “The big winners come from the so-called high-risk categories, but the risks have more to do with the investors than with the categories.”

- The stocks that have the most upside are the smaller cap stocks that have a lot of room to grow. These are riskier though because you’re investing when they are still on the come up.

- Quote (P. 76): “The greatest advantage to investing in stocks, to one who accepts the uncertainties, is the extraordinary reward for being right.”

- If you do the research and invest successfully in companies that have a lot of growth potential, you can reap some big rewards.

Ch. 4: Passing the Mirror Test

- Before investing, you need to ask yourself three questions:

- Do I own a house?

- There are several reasons why owning a house is even better than owning stocks.

- Mortgage interest payments are tax-deductible.

- You can roll your money into a new house without paying taxes on the one you just sold with the 1031 Exchange.

- It’s a great hedge against inflation.

- If you hold it for a long time, the house is almost guaranteed to make money via appreciation.

- You can aquire a house by putting 20% or less down.

- There are several reasons why owning a house is even better than owning stocks.

- Do I need the money?

- If you need your money in the next 6 months to a year, don’t invest in stocks. It’s too risky.

- Do I have the personal qualities that will make me a successful investor?

- Successful investing requires discipline, patience, and bravery.

- Your emotions can’t be swayed by what other people are doing. When the market declines and everyone starts panic selling, you have to resist that urge to do the same.

- Most of the time, the herd is wrong.

- Quote (P. 82): “It’s amazing how quickly investor sentiment can be reversed, even when reality hasn’t changed.”

- Quote (P. 83): “The true contrarian waits for things to cool down and buys stocks that nobody cares about.”

- Quote (P. 83): “The trick is not to learn to trust your gut feeling, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.”

- Do I own a house?

Ch. 5: Is This a Good Market? Please Don't Ask.

- Interest rates and stock market performance are fairly correlated.

- When prevailing interest rates are high, people usually get out of stocks and go into bonds.

- When prevailing interest rates are low, people usually flock to stocks because bond yields are low.

- Interest rates also affect companies in multiple ways.

- Ex. When interest rates are elevated, the cost of debt is higher, which cuts into the bottom line because interest payments are more expensive for the year.

- Quote (P. 88): “I don’t believe in predicting markets. I believe in buying great companies — especially companies that are undervalued, and/or under appreciated.”

- Don’t focus on ‘timing’ the market as many day traders do. Instead, focus on acquiring good companies at good prices. Then hold them.

- Quote (P. 89): “The market ought to be irrelevant. If I could convince you of this one thing, I’d feel this book has done its job. And if you don’t believe me, believe Warren Buffett. ‘As far as I’m concerned,’ Buffett has written, ‘the stock market doesn’t exist. It’s is there only as a reference to see if anybody is offering to do anything foolish.’”

- Don’t allow what’s happening in the market to distract you from researching, buying, and holding GREAT companies.

- The market is very unpredictable and sometimes plain crazy.

- Don’t allow what’s happening in the market to distract you from researching, buying, and holding GREAT companies.

- Quote (P. 90): “If you rely on the market to drag your stock along, then you might as well take the bus to Atlantic City and bet on black or red… If you want to worry about something, worry about whether Taco Bell is doing well with its new Burrito Supreme. Pick the right stocks and the market will take care of itself.”

- Just because the market and economy are prospering doesn’t mean EVERY stock is going to perform well.

- You still have to pick good companies, even if the market is doing well overall.

- It’s entirely possible to pick stocks that lose money in a good market if you’re not careful.

- Just because the market and economy are prospering doesn’t mean EVERY stock is going to perform well.

- Invest in companies, not in the stock market. Ignore short-term market fluctuations.

- Don’t focus on the day-to-day fluctuations of the stock market. Focus on buying good companies that have a bright future ahead.

Ch. 6: Stalking the Tenbagger

- Keep your eyes open! Some of the best companies to invest in are those that produce products or services that you use regularly.

- Invest in what you know.

- Try to spot trends or things/products that seem to be catching on with people.

- When it comes to pharmaceutical companies, you want to invest in ones that produce a drug that is very effective and requires patients to continuously buy more of it to cure the ailment.

- It seems very wrong, but this sequence drives profits for the company and investors.

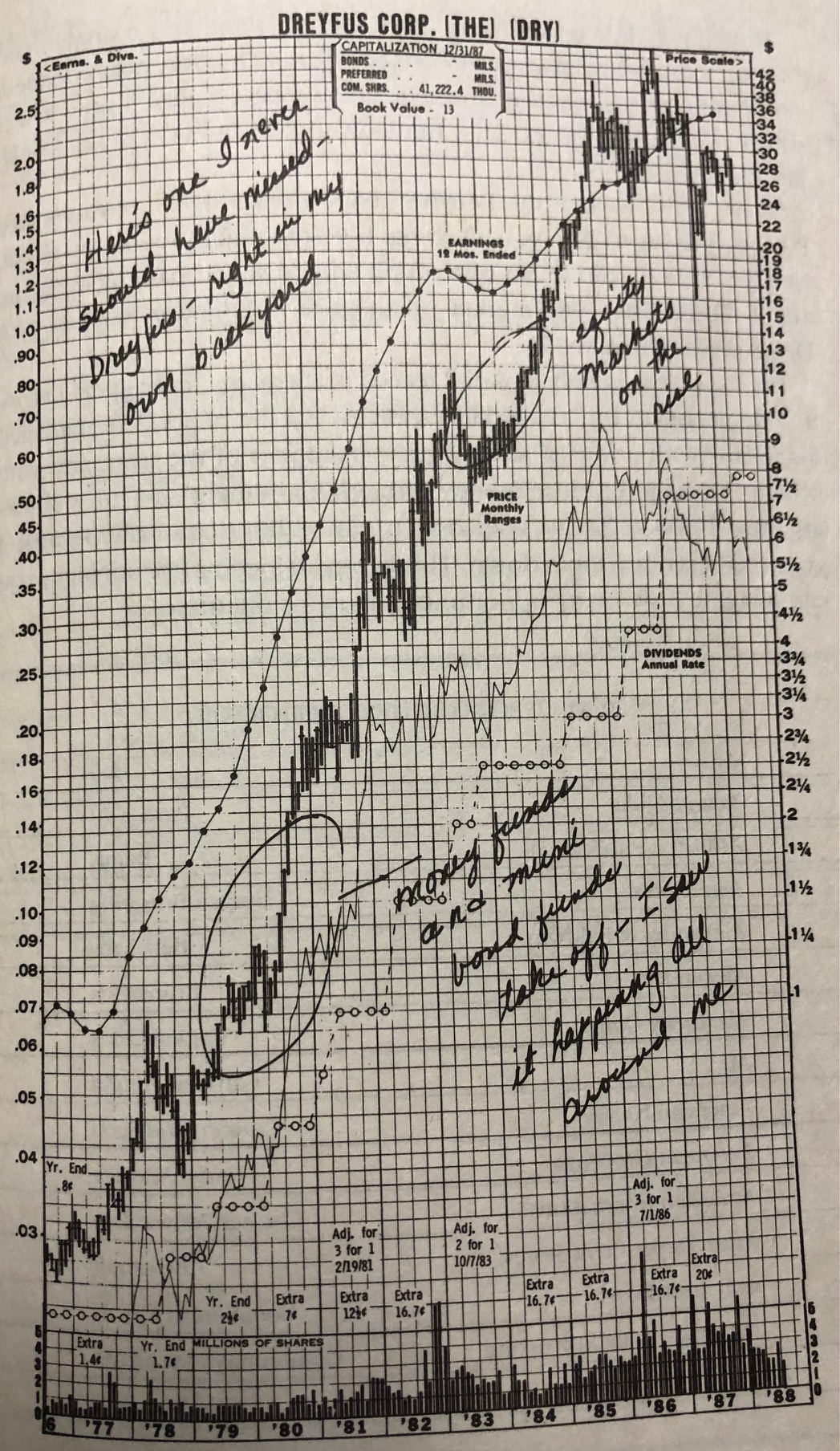

- Lynch used stock charts religiously. These were great tools for him.

- He liked to show trend lines for EPS and market price on the same chart because stock prices have historically mirrored earnings.

- If the stock price line is far above the earnings line, tread lightly.

- If the stock price is far below earnings, it could be a good buy.

- He liked to show trend lines for EPS and market price on the same chart because stock prices have historically mirrored earnings.

- Earnings (EPS) drive stock prices.

- Quote (P. 101): “You’re looking for a situation where the value of the assets per share exceeds the price per share of the stock. In such delightful instances, you can truly buy a great deal of something for nothing.”

- You want book value per share to exceed the market price of the stock.

Ch. 7: I’ve Got It, I’ve Got It — What Is It?

- Doing the necessary homework on a company only takes a few hours at the most.

- Most people are willing to spend hours looking into toilet paper brands when considering a change, but are unwilling to look into the fundamentals of a company before investing $5,000 in it.

- If considering a company based on the strength of a product, make sure that product accounts for a good chunk of the company’s overall revenue and net profit/earnings.

- If the product is a major driver of sales and net profit, it may be worth investing in the company.

- Ex. 1988 — Aspirin accounted for 15% of Sterling Drug’s total net profit, making it the company’s most profitable product. This was at a time when Aspirin was rising in popularity.

- Quote (P. 109): “The size of a company has a great deal to do with what you can expect to get out of the stock. How big is this company in which you’ve taken an interest? Specific products aside, big companies don’t have big stock moves. In certain markets they perform well, but you’ll get your biggest moves in smaller companies.”

- You’re going to get your biggest gains from small-to-mid cap companies. These have the most room for expansion and earnings growth over the long-term.

- Big companies have much less room to grow.

- Slow-growing companies normally move in unison with the nation’s growth rate — the GNP — which usually averages about 3%.

- Fast-growing companies can move as much as 20-30% or more.

Six Stock Categories

- The Slow Growers

- 2-4% earnings growth rate.

- These are big companies that have already done most of their growing and expanding. There’s no more room to stretch.

- Many of these companies have so much extra cash, and have already expanded tremendously, that they opt to pay a dividend to shareholders.

- The stock price chart usually looks like a line of flat hills.

- Quote (P. 112): “If growth in earnings is what enriches a company, what’s the sense of wasting time on sluggards.”

- The Stalwarts

- 10-12% earnings growth rate.

- These are big companies with steady growth rates and almost never have a red quarter. They are good to have for protection against recessions.

- Ex. Kellogg. People may hold off on buying cars and expensive clothes during a recession, but they don’t stop buying corn flakes.

- The Fast Growers

- 20-25% earnings growth rate.

- These are smaller companies that have a lot of potential growth ahead of them.

- If you can hit on one or two of these, you can make some good money.

- Because they are smaller and newer companies, these do tend to be a bit more risky.

- Quote (P. 118): “The expansion into new markets results in the acceleration in earnings that drives the stock price to giddy heights.”

- More expansion = more earnings = higher stock price.

- This is partly why I’m high on DraftKings. As sports betting continues to become legalized in more states, revenue and earnings should keep climbing.

- The Cyclicals

- These are companies who’s performance is tied to the performance of the economy.

- Ex. Airlines, Automobiles, Steel, Chemicals.

- When the economy is thriving, demand for the products of cyclical companies also thrives. When the economy is faltering, these products and companies fall on hard times with it.

- Ex. Airlines — When the economy is booming, people want to take vacations and fly. When the economy is not doing well, people conserve their money and don’t go on unnecessary flights.

- Cyclicals can be tricky because they are usually big companies that you would think are stable investments on the surface.

- These are companies who’s performance is tied to the performance of the economy.

- The Turnarounds

- These are once great companies that have fallen on hard times and are on the brink of bankruptcy.

- Many big, formerly successful companies in this situation are able to rebound, so they make for good investments if you are careful.

- Ex. 1980s — Chrysler

- Sometimes, a company puts itself in this position after some poor decisions by management.

- Ex. Acquiring other companies it shouldn’t have acquired, launching a new product it shouldn’t have launched, etc.

- Other times, a company might find itself in this situation after some kind of tragic event.

- Ex. Boeing after a few of its planes crashed.

- These are once great companies that have fallen on hard times and are on the brink of bankruptcy.

- The Asset Plays

- These are companies that are sitting on a huge asset, whether it be cash, real estate, or some other part of the business that is undervalued.

- Ex. Starbucks — This is a company that owns most of its stores. The real estate is a huge asset for the company.

- These are companies that are sitting on a huge asset, whether it be cash, real estate, or some other part of the business that is undervalued.

- Placing your investment in one of these categories is the first step to establishing the company’s story.

Ch. 8: The Perfect Stock, What a Deal!

- The better you understand a company’s business, the better your chances of a successful investment.

- Invest in what you know.

13 Characteristics of a ‘Good Stock’

- It Sounds Dull

- If the company name is dull and unexciting, there’s a good chance you can get it for cheap.

- People like to invest in companies which flashy names and ticker symbols.

- Ex. Tesla (TSLA)

- Obviously, the earnings need to be strong and the balance sheet needs to be sound before investing in the company.

- It Does Something Dull

- The company is even more likely to be undervalued by the market if its core business is very boring.

- It Does Something Disagreeable

- The company will likely fall under the radar if it’s core business is doing something nasty or strange.

- It’s a Spinoff

- Subsidiaries that ‘spinoff’ from a parent company have historically been pretty successful.

- Ex. ATT — In the 1980s, ATT split up into seven smaller companies. The smaller spinoffs each went up 114% from 1983-88.

- Subsidiaries that ‘spinoff’ from a parent company have historically been pretty successful.

- The Institutions Don’t Own It, And The Analysts Don’t Follow It

- Good stocks that have very little institutional ownership and a small analyst following can blow up in a good way.

- When the institutions begin to buy shares in bulk, the stock price balloons.

- The Rumors Abound: It’s Involved With Toxic Waste And/Or The Mafia

- Rumors can send stock prices all over the place.

- There’s Something Depressing About It

- Funeral-related stocks can sometimes be undervalued.

- It’s a No-Growth Industry

- Boring, slow-moving industries can be great because there is very little competition. Nobody wants to enter a boring industry.

- When an industry has a lot of players, competitors fight for customers, often dropping their prices. This means sales and earnings are going to fall for everyone because everyone will need to cut prices.

- Boring, slow-moving industries can be great because there is very little competition. Nobody wants to enter a boring industry.

- It’s Got A Niche

- Companies that specialize in uncommon products or services can be good investments because there isn’t a lot of competition for market share.

- Ex. There are tons of jeweler companies.

- Additionally, companies that have tough barriers to entry can be good investments.

- Ex. Pharmaceutical companies.

- Companies that specialize in uncommon products or services can be good investments because there isn’t a lot of competition for market share.

- People Have to Keep Buying It

- You want companies that produce products that have to be repurchased over and over.

- Ex. Drugs, soda, razor blades, cigarettes, etc.

- Companies that make products that are one-time purchases can suffer over time.

- Ex. Toy stores.

- You want companies that produce products that have to be repurchased over and over.

- It’s a User of Technology

- Companies that use technology well can produce products at lower costs, which boosts earnings.

- The Insiders Are Buyers

- Quote (P. 12): “There’s no better tip-off to the probable success of a stock than that people in the company are putting their own money into it.”

- If insiders are buying stock, it means they believe in the company and the stock is selling at a good price. Insider buying is a great sign.

- Yahoo Finance, The Wall Street Journal, and other websites have this info readily available.

- When insiders buy stock, they have to report it on Form 4 and send it to the SEC.

- It really doesn’t mean much if an insider is selling.

- When an insider sells, it could be because they need cash for their kid’s college tuition, or buy a house, or something else. It’s not automatically a bad sign when they sell.

- But when an insider buys, it’s for one reason — they believe in the company and think the stock is undervalued.

- Quote (P. 12): “There’s no better tip-off to the probable success of a stock than that people in the company are putting their own money into it.”

- The Company is Buying Back Shares

- Buying back shares is the simplest and best way a company can reward investors.

- When a company buys its own shares in the market, it’s because it believes in its own future and it believes its shares are undervalued.

- When a company buys its own shares, it reduces its number of outstanding shares in the market.

- This elevates Earnings Per Share (EPS) AND drives up the stock price (because there are less shares in the market).

- This allows shareholders to sell their shares in the market for boosted prices. Yes, please.

- This elevates Earnings Per Share (EPS) AND drives up the stock price (because there are less shares in the market).

- When a company sells more stock to raise more cash, it has the opposite effect on EPS and share price.

- It dilutes each shareholder’s ownership percentage in the company and lowers the stock price.

- Buying back shares is the simplest and best way a company can reward investors.

Ch. 9: Stocks I'd Avoid

- Avoid — or at least be skeptical of —‘hot’ stocks.

- Hot stocks are the ones that are flashy and buzzing on social media. They are also covered in the media a lot. They are hyped up.

- Ex. To some extent, Tesla.

- Hot stocks can go up very quickly, but they can also tank very quickly. Have to be careful.

- Hot stocks are the ones that are flashy and buzzing on social media. They are also covered in the media a lot. They are hyped up.

- Five key ways companies grow earnings:

- Increase market share via expansion

- Raise prices

- Lower costs

- Sell more product in existing markets

- Close an underperforming leg of the company, opening up more cash

- Avoid companies that are making a lot of acquisitions. These usually don’t go well.

- Quote (P. 157): “There’s a strong tendency for companies that are flush with cash and feeling powerful to overpay for acquisitions, expect too much from them, and then mismanage them. I’d rather see a vigorous buyback of shares.”

- Be careful with supply companies that sell primarily to one or two big customers.

- You never know when those one or two customers might decide to take their business elsewhere.

Ch. 10: Earnings, Earnings, Earnings

- Earnings (EPS) and net assets (book value) drive stock prices.

- A good way to think of this relationship is to put yourself in the position of the company that’s being analyzed.

- If you were a stock, your earnings (wage) and assets (possessions) would drive your personal stock price.

- As you personally earn raises at work and acquire more material possessions (like houses, jewelers, cars, etc.), your personal stock price would go up. It’s the same with companies.

- You can also put people in the six categories of stocks to help understand this concept.

- Ex. Athlete — Fast Grower

- Ex. Lawyer — Stalwart

- Ex. Christmas Tree Salesman — Cyclical

- Ex. Unemployed Person — Turnaround

- If you were a stock, your earnings (wage) and assets (possessions) would drive your personal stock price.

- A good way to think of this relationship is to put yourself in the position of the company that’s being analyzed.

- Quote (P. 163): “When you buy stock in a fast-growing company, you’re really betting on its chances to earn more money in the future.”

- Young growth companies usually have very high P/E ratios because investors are willing to pay a premium to get in on the stock now, even if the company has no — or very low— earnings at the moment.

- They are anticipating big jumps in earnings in the future.

- Young growth companies usually have very high P/E ratios because investors are willing to pay a premium to get in on the stock now, even if the company has no — or very low— earnings at the moment.

- Earnings and stock price have historically been very strongly correlated.

- Stock charts that show an earnings line alongside a stock price line prove this. Stock price follows earnings.

- A quick way to tell if a stock is overpriced is to compare the stock price line to the earnings line.

- If the stock price is out ahead of the earnings line, it’s likely going to pull back at some point.

- If the stock price is trailing earnings by a good margin, it’s likely going to catch up soon.

- Quote (P. 164): “People may bet on the hourly wiggles in the market, but it’s the earnings that waggle the wiggles, long term.”

- The P/E Ratio — A multiple that shows the relationship between price and earnings.

- Market Price / EPS

- The stock is trading at times earnings.

- The P/E Ratio shows whether a company is overpriced, fairly priced, or underpriced in comparison to its earnings.

- Quote (P. 169): “The P/E Ratio can be thought of as the number of years it will take the company to earn back the amount of your initial investment — assuming the company’s earnings stay constant.”

- Ex. P/E of 10 — 10 years

- P/E Ratios tend to be higher for fast growing companies and lower for slow moving companies.

- Again, this is because investors are willing to gamble on fast growing companies by paying more for the stock. They are anticipating that earnings will continue to grow quickly.

- Quote (P. 170): “A company with a high p/e must have incredible earnings growth to justify the high price that’s been put on the stock. In 1972, McDonald’s was the same great company it had always been, but the stock was bid up to $75 per share, which gave it a P/E of 50. There was no way that McDonald’s could live up to those expectations, and the stock price fell from $75 to $25, sending the P/E back to a more realistic $13. There wasn’t anything wrong with McDonald’s. It was simply overpriced at $75 in 1972.”

- Again, looking at the P/E Ratio is a good way to see if the stock is overpriced, fairly priced, or underpriced.

- Like individual companies, the market has a P/E Ratio as well. In a bull market, the P/E is usually very high because people are optimistic and paying more for stocks.

Ch. 11: The Two-Minute Drill

- After you’ve looked into the P/Ratio and earnings, find out HOW the company intends to grow and expand going forward.

- This requires a good amount of research.

- Develop a future outlook synopsis — or story script —based on your research that can be explained verbally in 2 or 3 minutes.

- Answering these questions will help you develop a company’s story:

- What are the positives this year?

- What are the negatives this year?

Ch. 12: Getting the Facts

- When looking at the balance sheet, key items to analyze include:

- Cash Position — Compared to previous years, is the company putting away more cash and increasing marketable securities (which is basically cash)? If so, that’s a great sign.

- Long Term Debt — Compared to previous years, is the company reducing its long term debt? If so, that’s a great sign.

- Net Cash Position — Add cash and marketable securities together to get the ‘total cash position’, then subtract long term debt to get the ‘net cash position.’

- This numbers shows you how much more cash the company has compared to debt.

- Divide this by total common shares outstanding to get net cash per share.

- Ideally, one of the most favorable trends you want to see occurring on a balance sheet is an increase in cash and marketable securities, and a decrease in long term debt. The company is in strong financial shape.

- If the trend is going the opposite way — debt is increasing relative to cash — you need to be skeptical. The company is in weak financial shape.

- Note — Short term debt isn’t super important, per the author.

- Ideally, one of the most favorable trends you want to see occurring on a balance sheet is an increase in cash and marketable securities, and a decrease in long term debt. The company is in strong financial shape.

Ch. 13: Some Famous Numbers

- There are a few numbers Lynch pays most attention to when looking at a company’s financial reports.

Percent of Sales

- If a certain product is the reason you’re investing in a company, find out what percentage of sales that product represents.

- Divide sales for that product’s division into total sales to find this.

- If the product accounts for a larger percentage of total sales, the company might be worth buying.

P/E Ratio

- Compare the P/E to the company’s earnings growth rate.

- If the P/E is lower than the year-over-year earnings growth rate, you may have a good deal.

- This would mean the company is trading at an undervalued price relative to its rate of growth. This is good for you as an interested buyer.

- If the P/E is lower than the year-over-year earnings growth rate, you may have a good deal.

Cash Position

- The net cash per share number can be subtracted from the market price to give you a more realistic look at what the stock is selling for.

- Ex. 1988 — Ford had a net cash position of $16 per share compared to a market price of $38 per share. This means you were really buying the company for $22 per share.

- Cash is king. When a company has a lot of it, it has options. It can:

- Buy back shares

- Pay a dividend

- Expand the business

- Buy a company

Debt-to-Equity

- You’d like to see a company use as little debt as possible when financing its operations. The debt-to-equity ratio helps you see how the company is capitalized.

- Young companies with a lot of debt are very risky!

- Debt is a big item to watch. If debt exceeds cash, you need to stay away.

- D/E Ratio — Long Term Debt / Shareholders’ Equity

- Ex. 1987 — Ford had 91% equity to 9% debt. This is wonderful.

- The type of debt is very important as well.

- Bank debt is owed to the bank on demand. If you don’t have enough cash to pay the debt when the bank comes calling, you’re done.

- Debt owed to investors via corporate bonds usually isn’t due for long periods of time. It gives the company wiggle room.

Book Value

- The book value shows the net asset position of the company.

- Book Value — Total Assets – Total Liabilities

- Divide this by number of shares outstanding to get book value per share.

- If book value per share exceeds the market price per share, you may have a good deal.

Inventory

- For retailers, inventory build up is especially bad.

- When inventory gets excessive, it means the company can’t sell its products. This usually leads to slashing of prices and, therefore, reduced earnings.

Growth Rate

- The only growth rate that really matters is earnings.

- Is the company increasing prices and lowering costs?

Ch. 14: Rechecking the Story

- There are three phases in a company’s lifespan:

- The Start-Up Phase

- The company works on getting off the ground and becoming profitable.

- The Rapid Expansion Phase

- Move into new markets and grow year-over-year earnings.

- Mature Phase

- Find new ways to grow and expand.

- The Start-Up Phase

- Its important to know where each of your companies are in their life cycle and if they are successfully handling the challenges of each phase.

- The ‘Mature Phase’ is the most problematic because the company has to begin to get creative to continue its growth.

- Ex. McDonald’s is everywhere. The company has to continue to innovate and find new ways to grow earnings because it has already completely saturated the market. Drive-through windows and a breakfast menu are some of the ways McDonald’s has continued to innovate.

- The ‘Mature Phase’ is the most problematic because the company has to begin to get creative to continue its growth.

- Its important to know where each of your companies are in their life cycle and if they are successfully handling the challenges of each phase.

- Quote (P. 232): “Carefully consider the price-earnings ratio. If the stock is grossly overpriced, even if everything goes right, you won’t make money.”

Ch. 16: Designing a Portfolio

- Quote (P. 237): “It’s only by sticking to a strategy through good years and bad that you’ll maximize your long term gains.”

- You can’t allow dips in the market to cause you to lose your cool. Stay the course.

- Historically, the stock market has returned about 9-10% per year.

- There are index funds that track the S&P 500 that will give you those results with little hassle and almost zero management fees.

- You should shoot for at least a 12-15% long-term return if you are taking the time to pick individual stocks.

- There are index funds that track the S&P 500 that will give you those results with little hassle and almost zero management fees.

- When building a portfolio, don’t invest in unknown companies just for the sake of diversifying. Make sure they are good investments.

- Don’t have more than 30-40% of your portfolio in growth stocks. Spread your money out in companies located in the six categories previously discussed.

- The biggest keys to building a strong portfolio are:

- Do your research and select good companies with a solid growth path ahead.

- Don’t overpay for stocks.

- P/E Ratio is big here.

- Smart diversification.

- Go after the big growers when you’re young. You have time and earning power on your side.

- As you get older, adjust to a more conservative portfolio that preserves your money.

- The best portfolio strategy is to decide that you want X amount of money in the stock market and never pull it out. Instead, ROTATE the money into different companies.

- If you have a stock that has done really well and you believe the company’s fundamentals are slipping, sell it and buy another stock in the same category that has a low price and good fundamentals.

- Quote (P. 243): “The current stock price tells us absolutely nothing about the future prospects of a company, and it occasionally moves in the opposite direction of the fundamentals.”

- Just because a stock’s price is doing bad doesn’t mean the company is doing bad.

- Always monitor the company’s story (fundamentals).

- If the fundamentals are still solid, buy more of the stock when the price drops randomly.

- Just because a stock’s price is doing bad doesn’t mean the company is doing bad.

- Quote (P. 243): “Get out of situations in which the fundamentals are worse and the price has increased, and into situations in which the fundamentals are better and the price is down.”

- A price drop is a chance to load up on good companies.

Ch. 17: The Best Time to Buy and Sell

- Two good times to buy:

- End of Year

- Historically, October-December is a time where a lot of people sell their losing stocks to claim a tax loss or withdraw money for the holidays. Stocks suffer.

- Big Market Dips

- When the market slides, the herd panic sells, which drives prices down a lot. You can find good companies at good prices if you have the courage.

- Ex. March 2020

- When the market slides, the herd panic sells, which drives prices down a lot. You can find good companies at good prices if you have the courage.

- End of Year

Ch. 18: The 12 Silliest (And Most Dangerous) Things People Say About Stock Prices

- Stock prices can do so many random things. The key that you have to constantly focus on is the company’s story.

- Are earnings growing each year?

- Is the company expanding into new markets?

- Is the company making smart moves with its cash and avoiding dumb acquisitions?

- Is the company creating new successful products to boost sales?

Ch. 19: Options, Futures, and Shorts

- Options, futures, and shorts can be risky if you don’t know what you’re doing.

- Shorting — When you borrow a certain number of shares from a broker and sell them in the open market for a high price. You’re betting that the stock will fall significantly, which will allow you to buy the stock back at a far lower price than what you sold it for and return the stock to the broker. You pocket that difference.

Ch. 20: 50,000 Frenchman Can Be Wrong

- Stock prices move up and down for so many random reasons. It’s impossible to predict over the short term.

- In the long run, good companies will produce good returns. A company’s stock price may ebb and flow randomly in the near term, but it will always produce the right result in the long run.

- Focus on finding good companies with good fundamentals and growth outlook.

- Historically, Mondays have been the worst performing day of the week for the market.

- People have two days to ponder and worry about what they’re doing with their money. On Monday, many people sell.